Wednesday’s FOMC minutes release has served as the first critical fundamental driver this week. However, the statements contained in this document came as no surprise to the market players, only confirming the Fed’s intention to slow down the pace of interest rate hikes.

Given these recent developments, there was no major change in the volatility of the dollar, and so the market participants’ focus shifted to Friday's release of the U.S. employment figures.

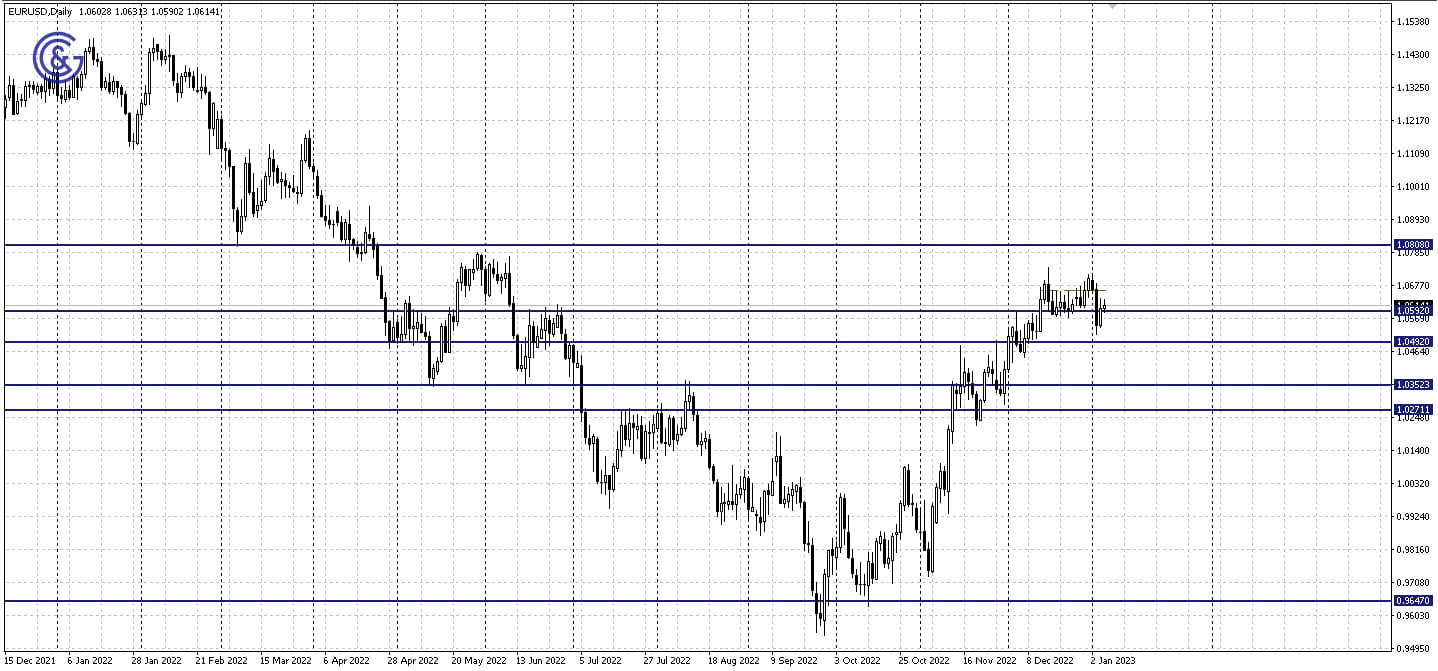

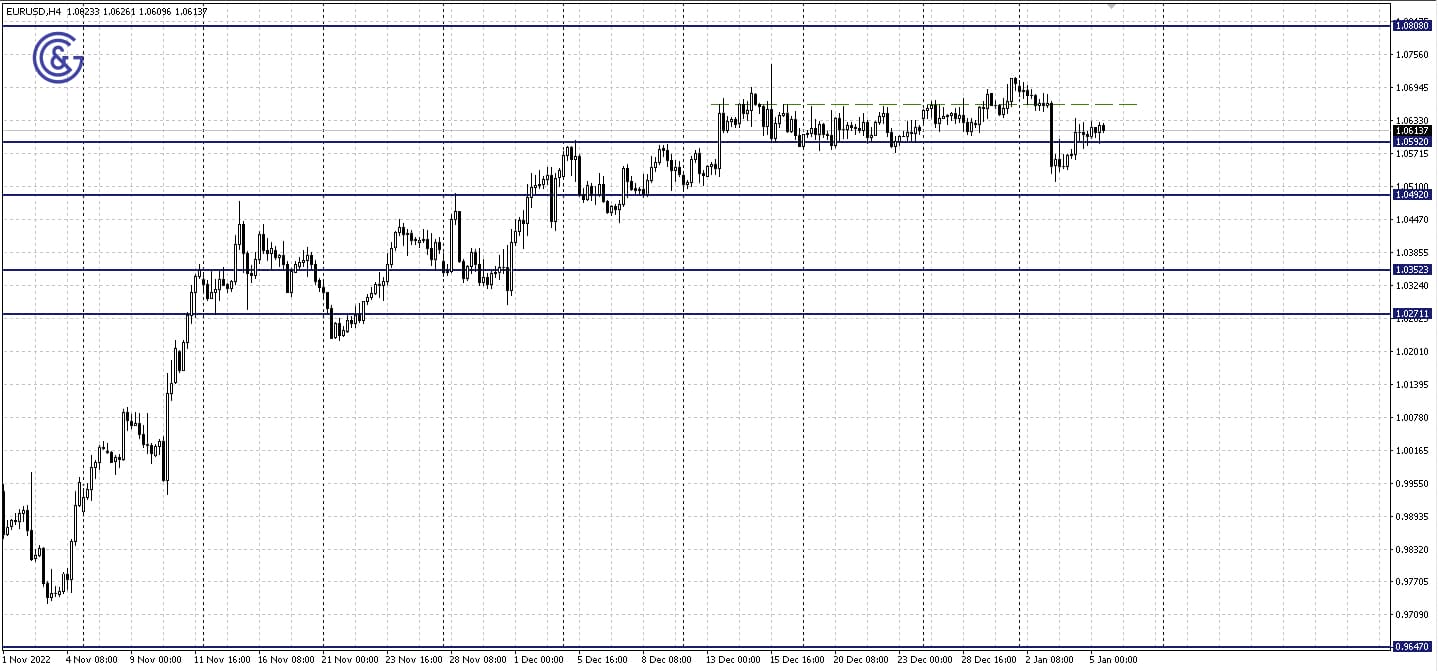

On the daily chart, the EUR/USD pair recouped a portion of losses earlier this week and returned to the 1.0592 level, attempting to go above it on Thursday. The technical scenario of an increase to December highs is possible; however, it may change based on the U.S. dollar’s behavior in response to Friday's news.

The U.S. labor market report for the month of December released at 1:30 PM GMT acts as the primary fundamental catalyst on Friday.

Nonfarm payrolls reflecting the change in the number of people engaged in the nonfarm sector are projected at 200,000 against 263,000 in the previous period, while the unemployment rate will remain unchanged at 3.7%.

On the 4H chart of the EUR/USD pair, we can see the pair consolidating at the 1.0592 support, while the resistance remains at the 1.0661 local level marked with a dotted line. That being said, the traditional spike in the dollar’s volatility in response to employment figures which rarely match those forecasted is likely to result in the technical benchmark update.

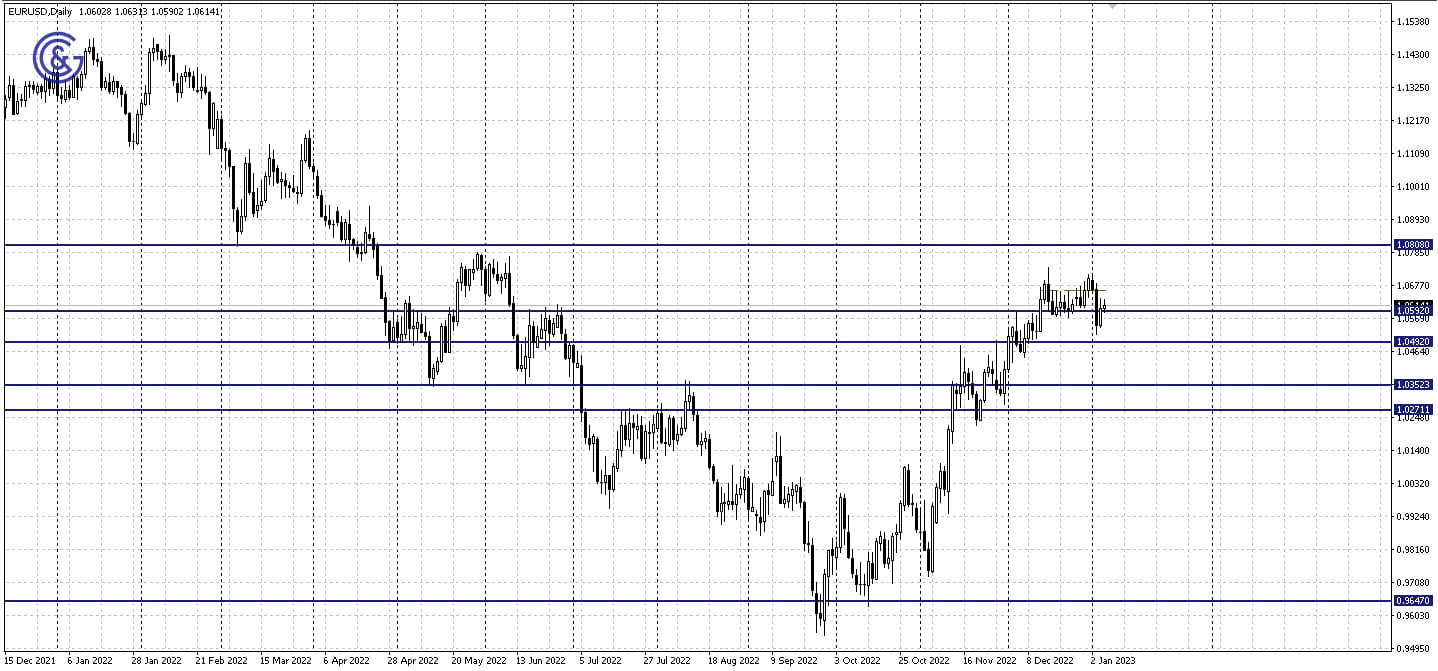

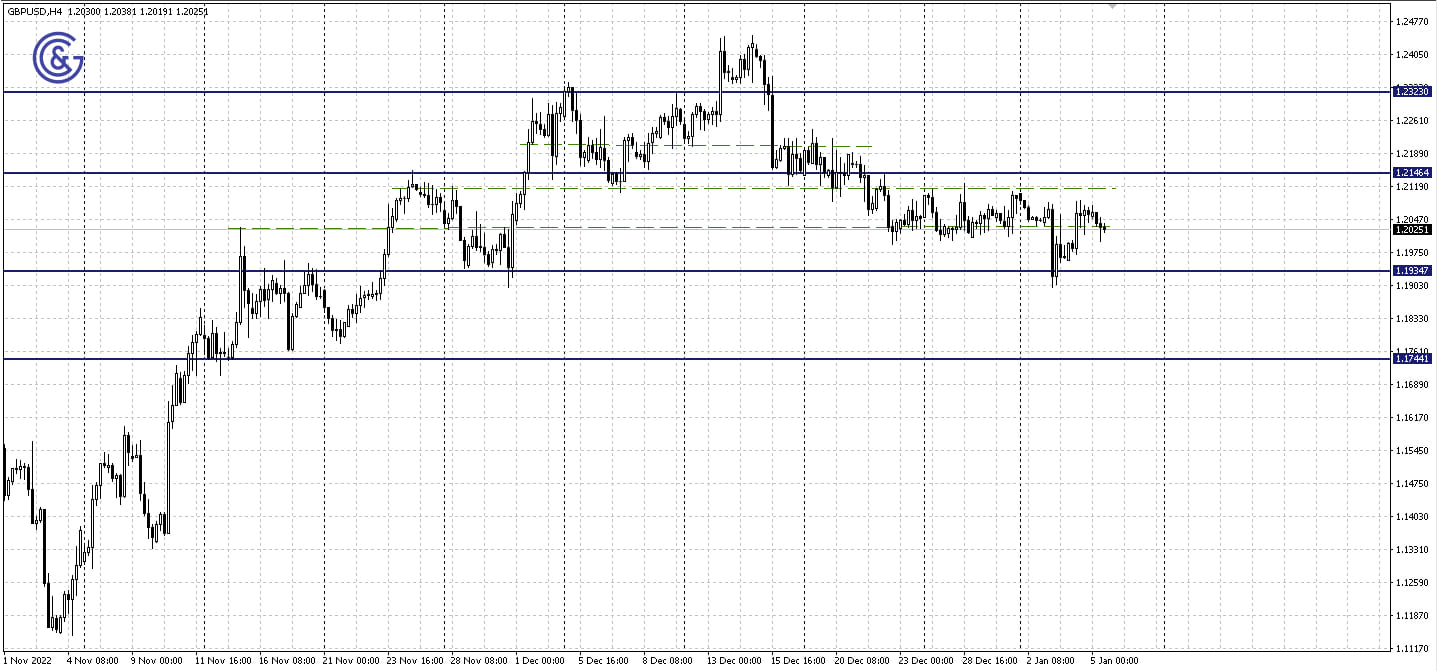

On Wednesday, the GBP/USD regained the losses of Tuesday’s trading session and remains beside these highs on Thursday. A further increase to the nearest resistance level will be possible if the U.S. currency grows weaker, as investors' main focus is now on the news from the United States.

On the daily chart of the GBP/USD pair, the price remains within the 1.1934 - 1.2146 sideways range, having the sufficient range to move toward its resistance. However, the price may not only pull back to support but also put its strength to the test if the U.S. dollar rises on Friday.

On Friday, market participants’ eyes will be on the U.S. labor market report for the month of December which is going to be released at 1:30 PM GMT.

The forecast suggests that nonfarm payrolls reflecting the change in the number of people engaged in the nonfarm sector will demonstrate an increase of 200,000 against 263,000 in the previous period, while the unemployment rate will remain unchanged at 3.7%.

On the 4H chart of the GBP/USD pair, the price pulled back to the support of the 1.2028 - 1.2112 local corridor between the two green dotted lines, putting its strength to the test. Given the anticipated news, we cannot yet talk about the strength of these technical benchmarks. That said, we can look for updated boundaries of trading benchmarks starting on Monday.

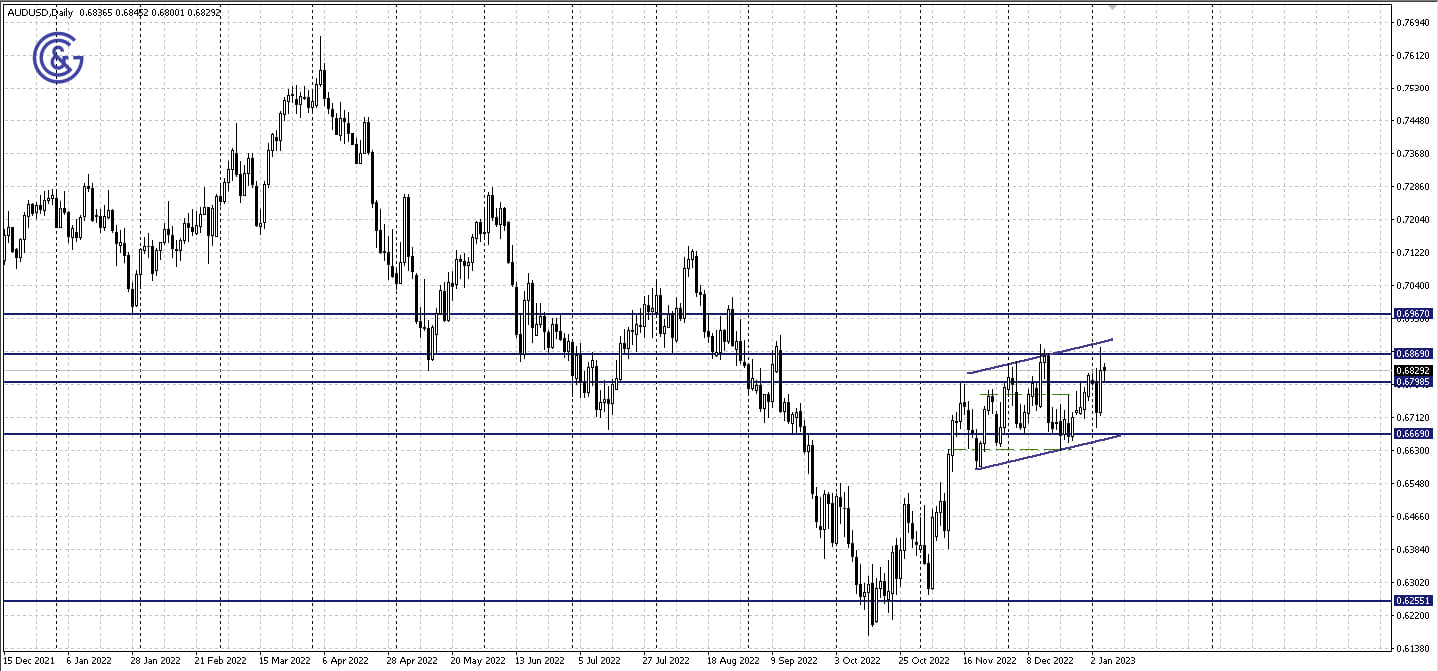

Against the backdrop of improved risk appetite, the Australian dollar went up locally against the US currency. It is worth mentioning that the improved situation in China, which remains to be Australia’s largest trading partner, is what contributed to this.

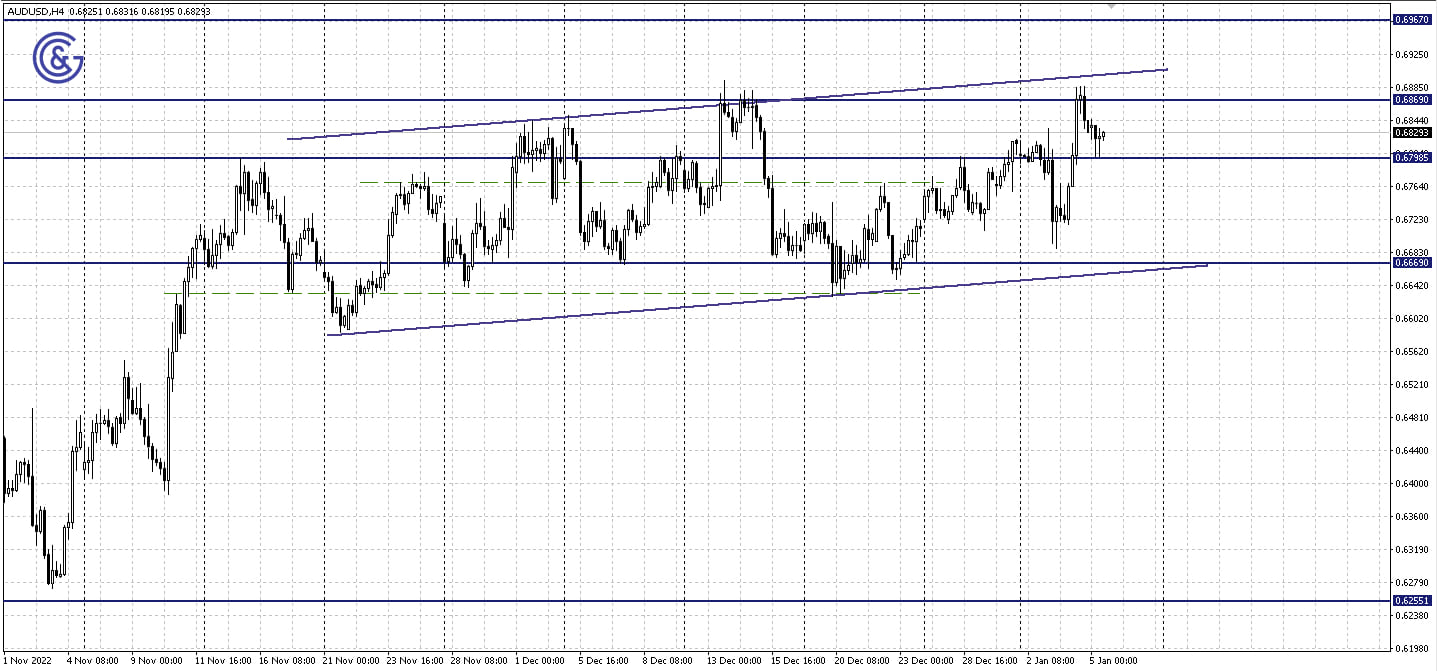

On the daily chart, the AUD/USD quotes remain at the top of the uptrend, maintaining enough range of movement toward its resistance. The nearest growth target is the 0.6869 resistance level whose strength can be put to the test.

Currently, two fundamental catalysts are affecting the AUD/USD dynamics. These are the situation in China and U.S. stats. Improved business activity in China against the backdrop of the likely removal of Covid restrictions will promote risk appetite and encourage the Australian dollar’s growth.

Meanwhile, the U.S. currency will be sensitive to the employment report for the month of December to be released on Friday at 1:30 PM GMT, which typically causes a volatility spike. Nonfarm payrolls are expected to demonstrate an increase of 200,000 against 263,000 in the previous period, while the unemployment rate will remain unchanged at 3.7%.

On the 4H chart, the AUD/USD pair bounced upward from the 0.6798 support level which opens the way for it to move to the next target at 0.6869 locally.